Mileagewise - Reconstructing Mileage Logs for Beginners

Mileagewise - Reconstructing Mileage Logs for Beginners

Blog Article

The Single Strategy To Use For Mileagewise - Reconstructing Mileage Logs

Table of Contents6 Easy Facts About Mileagewise - Reconstructing Mileage Logs ExplainedOur Mileagewise - Reconstructing Mileage Logs IdeasThe 5-Second Trick For Mileagewise - Reconstructing Mileage LogsGetting The Mileagewise - Reconstructing Mileage Logs To WorkThe Best Strategy To Use For Mileagewise - Reconstructing Mileage LogsGet This Report on Mileagewise - Reconstructing Mileage LogsNot known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

Timeero's Shortest Distance feature suggests the shortest driving path to your workers' location. This attribute enhances efficiency and adds to set you back savings, making it a crucial asset for organizations with a mobile workforce.Such a technique to reporting and compliance streamlines the commonly complex task of handling gas mileage expenses. There are numerous benefits related to utilizing Timeero to keep an eye on gas mileage. Allow's take an appearance at several of the application's most remarkable attributes. With a relied on gas mileage monitoring device, like Timeero there is no demand to bother with accidentally leaving out a day or item of info on timesheets when tax obligation time comes.

The 10-Second Trick For Mileagewise - Reconstructing Mileage Logs

With these tools in operation, there will certainly be no under-the-radar detours to enhance your reimbursement costs. Timestamps can be located on each mileage access, enhancing reliability. These added verification actions will maintain the IRS from having a factor to object your gas mileage records. With exact mileage monitoring innovation, your workers don't need to make rough gas mileage estimates or perhaps bother with gas mileage expense monitoring.

As an example, if a staff member drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all cars and truck expenditures. You will certainly require to proceed tracking gas mileage for job also if you're using the actual expense technique. Keeping gas mileage documents is the only method to different company and personal miles and offer the proof to the internal revenue service

A lot of gas mileage trackers let you log your journeys by hand while calculating the range and compensation amounts for you. Numerous also come with real-time trip monitoring - you need to begin the app at the beginning of your journey and quit it when you reach your final location. These apps log your start and end addresses, and time stamps, together with the complete distance and reimbursement amount.

Getting The Mileagewise - Reconstructing Mileage Logs To Work

Among the questions that The INTERNAL REVENUE SERVICE states that vehicle costs can be considered as an "normal and necessary" expense during operating. This consists of costs such as gas, upkeep, insurance coverage, and the lorry's devaluation. For these expenses to be taken into consideration insurance deductible, the vehicle must be made use of for business purposes.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About

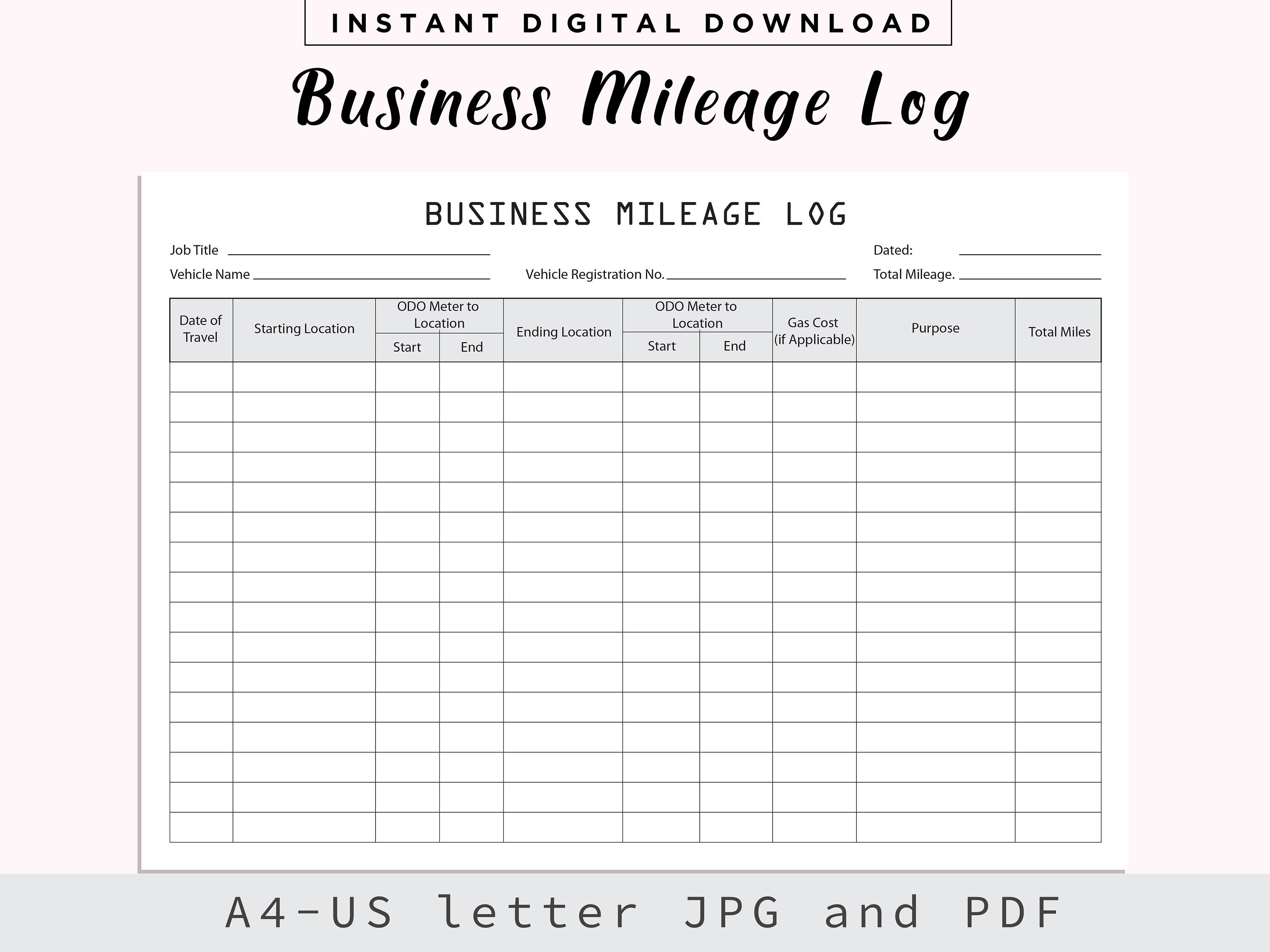

In in between, vigilantly track all your organization trips keeping in mind down the beginning and finishing readings. For each journey, document the location and organization purpose.

This consists of the total company gas mileage and total mileage buildup for the year (company + individual), journey's date, destination, and function. It's vital to tape activities immediately and maintain a simultaneous driving log outlining day, miles driven, and business function. Right here's just how you can improve record-keeping for audit functions: Beginning with making certain a precise gas mileage log for all business-related traveling.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

The real costs technique is an alternate to the typical gas mileage price technique. As opposed to calculating your deduction based upon an established rate per mile, the real expenses approach enables you to deduct the real prices related to utilizing your vehicle for business purposes - mileage tracker app. These costs consist of gas, upkeep, repair work, insurance policy, devaluation, and other associated expenses

Those with significant vehicle-related expenditures or distinct problems may benefit from the actual expenditures technique. Please note electing S-corp condition can transform this estimation. Inevitably, your chosen approach should line up with your particular economic objectives and tax obligation circumstance. The Criterion Gas Mileage Rate is a step provided every year by the IRS to establish the insurance deductible expenses of operating a vehicle for company.

The Mileagewise - Reconstructing Mileage Logs Ideas

(https://www.reverbnation.com/artist/mileagewisereconstructingmileagelogs)Determine your overall company miles by utilizing your start and end odometer readings, and your videotaped business miles. Accurately tracking your exact gas mileage for organization trips aids in corroborating your tax obligation deduction, especially if you decide for the Requirement Mileage technique.

Keeping track of my explanation your gas mileage manually can require diligence, however keep in mind, it might save you cash on your tax obligations. Videotape the overall mileage driven.

Mileagewise - Reconstructing Mileage Logs - Truths

And now nearly everyone makes use of GPS to get around. That indicates nearly everyone can be tracked as they go concerning their business.

Report this page