Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

Blog Article

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Discussing

Table of ContentsThe Ultimate Guide To Mileagewise - Reconstructing Mileage LogsWhat Does Mileagewise - Reconstructing Mileage Logs Mean?The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is DiscussingThe smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is DiscussingThe 10-Second Trick For Mileagewise - Reconstructing Mileage LogsUnknown Facts About Mileagewise - Reconstructing Mileage LogsHow Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.

Timeero's Quickest Range attribute suggests the fastest driving course to your employees' location. This function improves efficiency and contributes to cost financial savings, making it a crucial possession for services with a mobile workforce.Such a strategy to reporting and conformity streamlines the typically complex task of handling mileage expenditures. There are numerous advantages connected with utilizing Timeero to keep an eye on mileage. Let's have a look at a few of the application's most notable functions. With a trusted mileage monitoring tool, like Timeero there is no requirement to fret concerning accidentally omitting a date or piece of information on timesheets when tax time comes.

The Buzz on Mileagewise - Reconstructing Mileage Logs

With these devices being used, there will be no under-the-radar detours to raise your repayment prices. Timestamps can be discovered on each gas mileage entry, enhancing credibility. These additional confirmation procedures will keep the IRS from having a factor to object your mileage documents. With accurate gas mileage monitoring modern technology, your staff members don't need to make rough gas mileage estimates or also stress over mileage expense monitoring.

For instance, if a worker drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all automobile expenses. You will certainly need to proceed tracking mileage for job also if you're utilizing the actual expenditure approach. Maintaining mileage records is the only way to different service and individual miles and provide the proof to the internal revenue service

Most gas mileage trackers allow you log your journeys manually while calculating the range and repayment quantities for you. Numerous also come with real-time journey tracking - you need to begin the app at the begin of your journey and stop it when you reach your final destination. These applications log your begin and end addresses, and time stamps, along with the total distance and compensation amount.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

This includes expenses such as fuel, upkeep, insurance policy, and the lorry's devaluation. For these prices to be taken into consideration insurance deductible, the car must be utilized for service purposes.

Examine This Report about Mileagewise - Reconstructing Mileage Logs

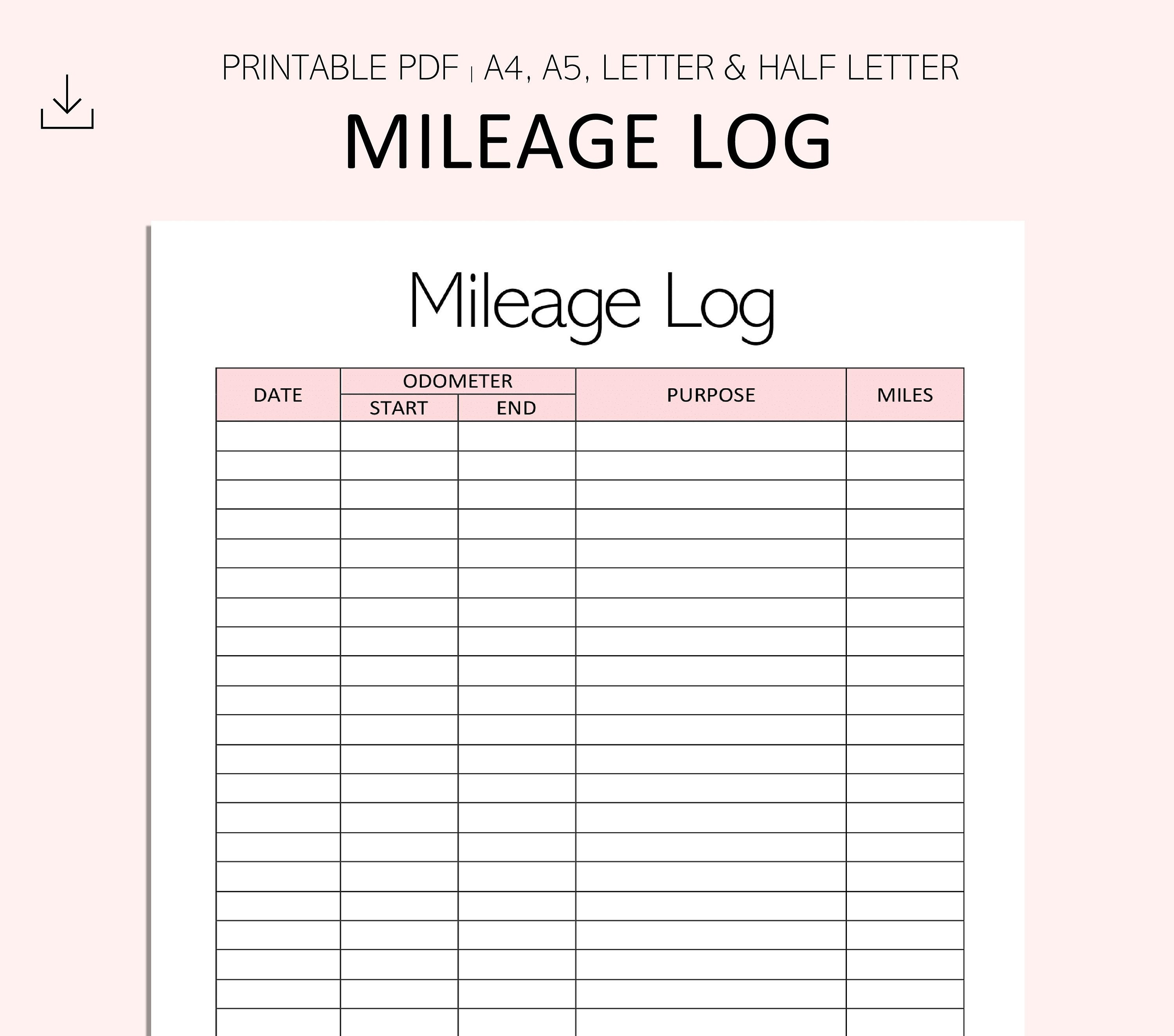

In in try this out between, vigilantly track all your organization trips noting down the beginning and ending analyses. For each trip, record the place and company function.

This includes the overall service gas mileage and overall gas mileage buildup for the year (business + personal), trip's day, location, and objective. It's necessary to videotape tasks without delay and keep a contemporaneous driving log outlining day, miles driven, and organization objective. Here's just how you can enhance record-keeping for audit purposes: Start with making certain a meticulous mileage log for all business-related traveling.

Not known Facts About Mileagewise - Reconstructing Mileage Logs

The actual costs approach is a different to the standard mileage price technique. Rather of computing your reduction based on an established price per mile, the actual expenditures approach permits you to deduct the real costs associated with utilizing your automobile for business functions - free mileage tracker. These expenses consist of gas, upkeep, repair work, insurance, devaluation, and other associated costs

Those with substantial vehicle-related expenditures or unique conditions may profit from the real expenses approach. Please note choosing S-corp standing can change this estimation. Inevitably, your chosen method must line up with your particular economic objectives and tax obligation circumstance. The Requirement Mileage Price is a procedure released yearly by the internal revenue service to determine the deductible costs of operating a car for organization.

Little Known Questions About Mileagewise - Reconstructing Mileage Logs.

(https://www.reverbnation.com/artist/mileagewisereconstructingmileagelogs)Whenever you utilize your car for service journeys, record the miles took a trip. At the end of the year, again keep in mind down the odometer analysis. Compute your overall service miles by using your start and end odometer readings, and your videotaped organization miles. Accurately tracking your precise mileage for organization trips help in validating your tax obligation deduction, especially if you opt for the Requirement Mileage technique.

Keeping track of your gas mileage manually can call for diligence, but keep in mind, it could save you cash on your tax obligations. Tape the overall gas mileage driven.

The Single Strategy To Use For Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline market became the first industrial individuals of GPS. By the 2000s, the shipping sector had actually embraced general practitioners to track bundles. And currently virtually every person makes use of general practitioners to get around. That indicates nearly everyone can be tracked as they set about their company. And there's the rub.

Report this page